All Categories

Featured

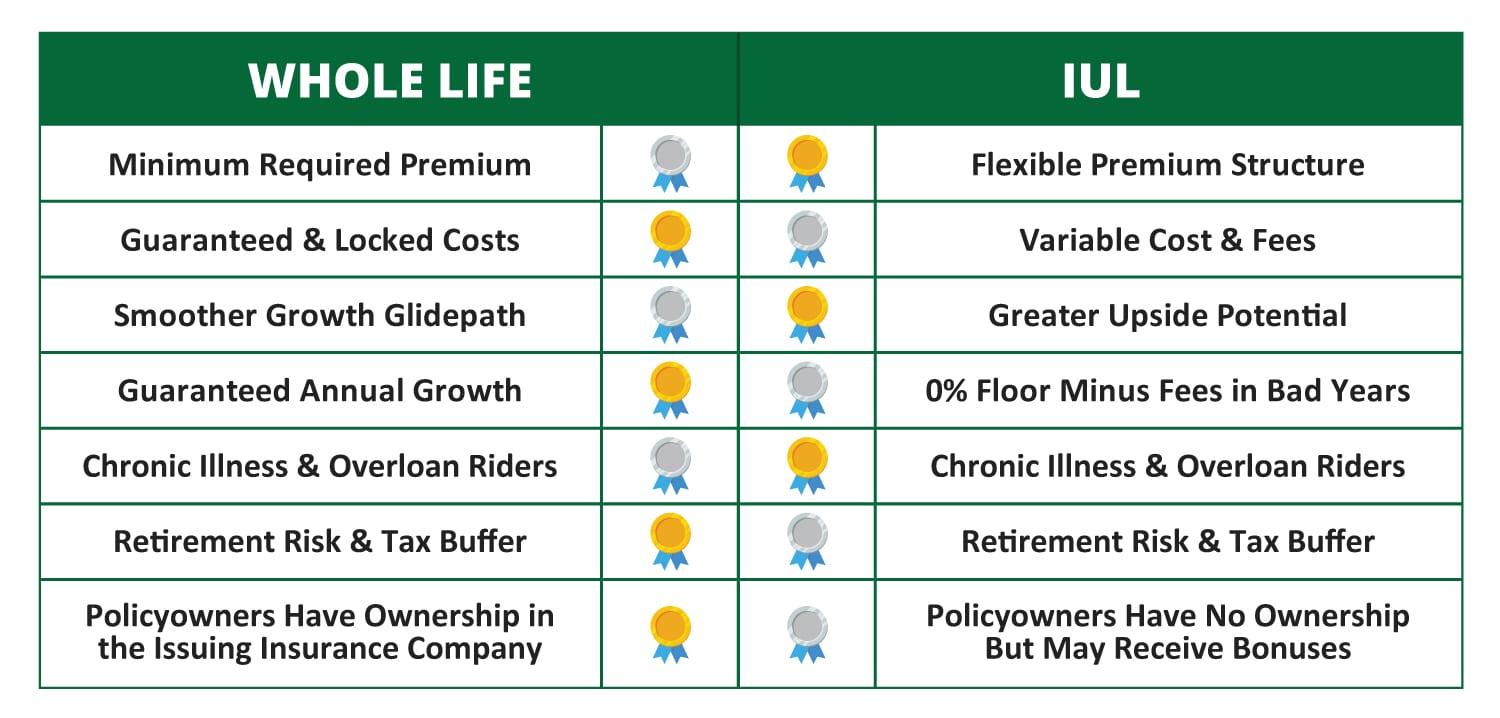

State Ranch representatives market every little thing from property owners to car, life, and various other preferred insurance products. State Farm supplies universal, survivorship, and joint universal life insurance plans - iul life insurance pros and cons.

State Ranch life insurance is normally conventional, supplying stable alternatives for the average American household. If you're looking for the wealth-building opportunities of universal life, State Ranch lacks competitive options.

However it does not have a solid existence in other financial items (like global plans that open up the door for wealth-building). Still, Nationwide life insurance policy plans are highly accessible to American households. The application process can also be much more workable. It aids interested events obtain their first step with a trusted life insurance policy plan without the far more complex discussions about financial investments, monetary indices, and so on.

Nationwide loads the important role of getting hesitant customers in the door. Even if the worst takes place and you can't obtain a bigger plan, having the protection of an Across the country life insurance plan can change a purchaser's end-of-life experience. Read our Nationwide Life insurance policy review. Insurance provider utilize medical examinations to gauge your risk course when using for life insurance policy.

Buyers have the alternative to transform rates each month based on life circumstances. A MassMutual life insurance policy agent or monetary consultant can assist buyers make plans with space for modifications to satisfy temporary and long-lasting monetary goals.

Universal Life Option 1

Review our MassMutual life insurance policy evaluation. USAA Life Insurance Coverage is understood for providing affordable and extensive monetary items to military members. Some customers might be stunned that it uses its life insurance plans to the public. Still, armed forces members appreciate distinct advantages. Your USAA plan comes with a Life Occasion Choice rider.

VULs feature the highest possible threat and the most potential gains. If your plan doesn't have a no-lapse guarantee, you might also shed insurance coverage if your cash money worth dips listed below a particular limit. With so much riding on your investments, VULs require continuous interest and maintenance. It may not be a terrific option for people who merely desire a fatality benefit.

There's a handful of metrics whereby you can evaluate an insurance coverage business. The J.D. Power client contentment rating is an excellent alternative if you want a concept of exactly how consumers like their insurance coverage plan. AM Ideal's economic toughness ranking is an additional essential metric to take into consideration when selecting an universal life insurance coverage company.

This is especially essential, as your money worth grows based upon the investment options that an insurance provider supplies. You must see what financial investment choices your insurance policy supplier deals and contrast it against the objectives you have for your policy. The most effective means to find life insurance policy is to gather quotes from as numerous life insurance policy firms as you can to recognize what you'll pay with each plan.

Latest Posts

Maximum Funded Universal Life Insurance

Low Cost Universal Life Insurance

Cost Of Universal Life Insurance